Overview

IOU Financial is a short-term loan provider catering to successful small businesses with a healthy cash flow. With its headquarters in Montreal, Canada, and a North American operations center in Atlanta, Georgia, IOU Financial has funded over $600 million in loans since 2009. It operates as a 100% paperless company (which won’t affect your loan application, but is just plain awesome). Loans up to $300k are available for clients with a credit score of 600 or higher. As with other short-term lenders, eligibility requirements are pretty lenient, while rates are relatively high. Therefore, check if you qualify for other small business loans with lower rates before deciding on a short-term loan with a company like IOU Financial. Bear in mind that making high daily repayments can be a big strain on your small business.

- No hidden fees and terms, very transparent compared to other lenders

- No prepayment penalties

- Easy application process with quick pre-approval online or via phone

- Possibility to renew your loan once you are 40% paid down if you need more than the maximum loan amount of $300,000

- Relatively high origination and other fees

- Daily/weekly repayments can be difficult to handle for small businesses with irregular cash flow

- Funding usually takes longer than the promised 24-48 hours

Services Offered & Types of Funding

- Loans up to $300k are available for clients with a credit score of 600 or highe

- Type of funding short-term loans

- Minimum time in business 1 year

- Loan amount $5,000 – $300,000

- Age of business 1+ year

- Minimum credit score 600

- Time until funding 24-48 hours

- Repayment terms 6-18 months

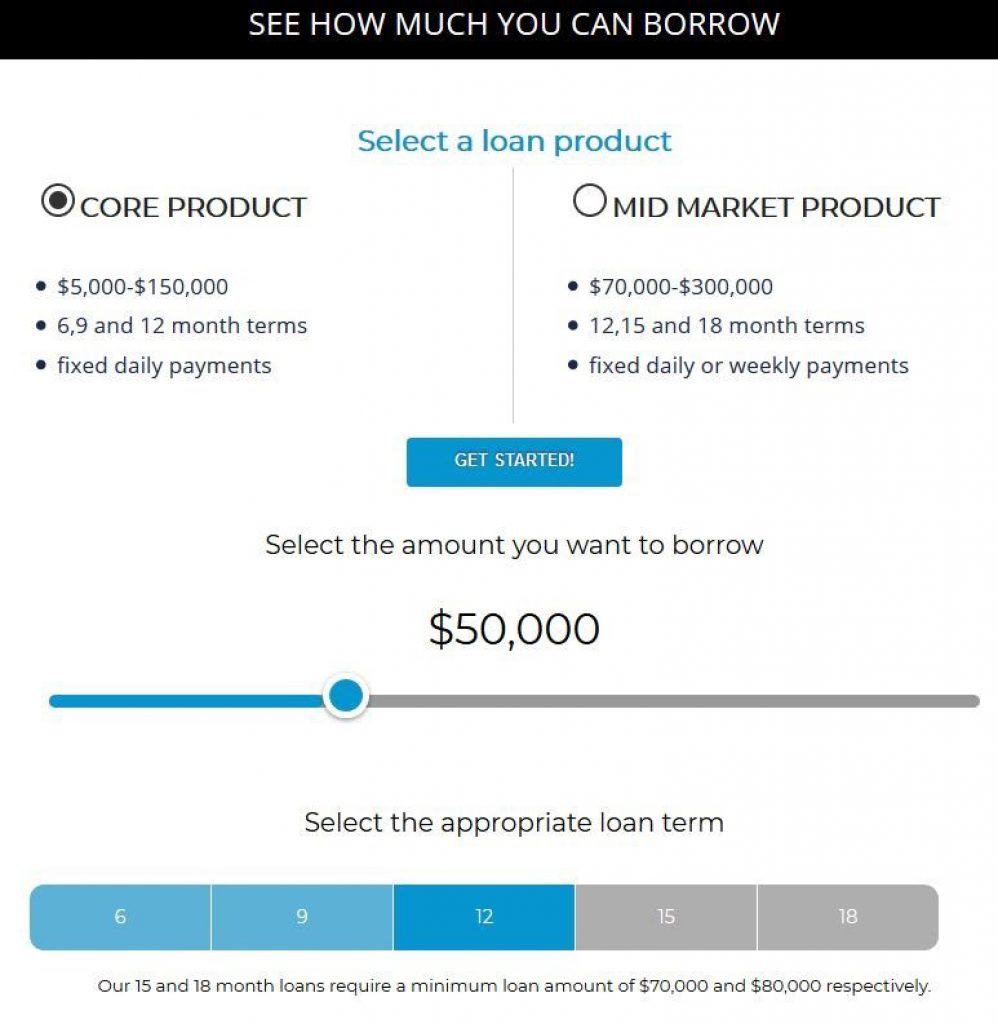

IOU Financial offers short-term loans with repayment terms from 6-18 months. The company divides their products into two sections. The first one is their so-called core product, which are term loans between $5,000-$150,000 with repayment terms that can be 6, 9, or 12 months, and fixed daily payments. The second one is their mid market product, which are loans between $70,000-$300,000, with repayment terms of 12, 15 or 18 months. With this type of loan you can potentially qualify for weekly instead of daily payments.

If somewhere down the line you realize the maximum loan amount of $300,000 is not enough, IOU Financial offers the option to easily renew your loan once you have paid back at least 40% of your original loan. Depending on your previous repayment history, you may be offered lower rates and higher loan amounts for your new loan.

One thing that stood out during this IOU Financial review is the company’s which helps you estimate how much you will be able to borrow and at what costs. It also shows you the amount of money you save in case you should decide to pay back your loan before your loan term period ends.

Rates and Fees

While IOU Financial’s rates and fees are not low, they are competitive. However, comparing the costs of IOU Financial’s loans to the products offered by other short-term lenders can be a little tricky since this company builds all fees, except the administration fee, into the factor rate you will be quoted. This includes the origination fee of of 8.8% of the loan amount, which is built into your repayment schedule, unlike with other lenders who usually deduct the fee from your overall loan amount. If your loan amount is $15,000, for example, a fee of $1,320.00 will be added to your loan amount. If the loan is renewed, the origination fee is reduced to 7.8% of the loan amount.

A Non Sufficient Funds fee (NSF fee) of $25 will be charged if your daily loan payment fails due to insufficient funds in your business account. Furthermore, if you decide to change bank accounts, you may incur an additional fee. A one-time administrative fee of $349.00 is charged for the general costs of managing your loan. IOU Financial also calculates a guarantee fee, assessed on your loan relative to the risk involved. It should be noted that payments are only made on business days, so you won’t be making any loan repayments on weekends or public holidays.

Let us look at an example. If you choose a loan of $5,000 with a loan term of 12 months, you will have 252 payments of $25 – $26 and your total payback will amount to $6,363 – $6,638. If you opt for a shorter term, IOU Financial will reduce their flat fees. If you choose the minimum loan term of 6 months for your loan amount of $5,000, you will be looking at 126 daily payments of $46 – $46, with the total payback amount being $5,763 – $5,788.

Another example of a bigger sized loan: a loan amount of $150,000 over the maximum loan term period of 18 months will mean 378 daily payments of $549 – $557 and a total payback amount of $207,633 – $210,633. If you opt for the shorter loan term of 15 months, for example, you will be looking at 315 daily payments of $632 – $639 and a total payback amount of $199,010 – $201,260.

One of the positive aspects of getting a loan with IOU Financial is the fact that the company does not charge a prepayment penalty. Whereas many other small business loan providers will charge you a penalty for paying back your loan early, with IOU Financial you only pay interest for the actual time you are using the loan.

Borrower Qualifications

If you are interested in applying for a small business loan at IOU Financial, you will have to meet a few requirements that are a little bit more strict compared to other short-term lenders. First of all, you will be asked to prove ownership of your business that equals at least 80%, or 50% if the business is co-owned with a spouse. To qualify for an IOU Financial small business loan, your business must be at least one year old, and must be fairly successful: you are expected to show an annual revenue of at least $100,000, with 10 or more deposits generated per month into your business bank account. IOU Financial also requires a $3,000 average daily balance over a three-month period as well as a personal guarantee.

Application Process

One of the clear advantages we discovered during this IOU Financial review is the quick and straightforward application process. While applying for a loan at a regular bank can take weeks and reqire a mountain of paperwork, IOU Financial proudly advertises a “3-minute application”, with a decision made within seconds. When you start the application process, there is an automated approval system that assesses your financial realities. This step involves filling out an online questionnaire, which takes just a few minutes. Those who prefer to go over this questionnaire on the phone are invited to call the helpline and fill in the answers with the assistance of an IOU Financial representative. If you meet all the required criteria and have all the documents needed for the application, you will be asked to call a company representative on the phone for a live closing process. Once you have accepted the loan, funding can be granted to you within a day or two, though it can sometimes take a bit longer. On their website, IOU Financial claims that most positive applications are processed within a maximum time frame of 48 hours, the company’s pre-approval rate being quite high at 80%. To check your eligibility for a small business loan, IOU Financial performs a soft credit pull, meaning that you don’t need to worry about your credit score being affected.

In order to make the application process as smooth as possible, make sure to have the following documents ready: three months of bank statements if applying for loans with 6-12 month terms, six months of bank statements and full tax returns if applying for loans with 12-18 month terms, a voided check, and your driver’s license.

If you apply for a small business loan with IOU Financial and it turns out that you do not qualify, you can re-apply 30 days after your first application. Just make sure to address the issues that made them reject you in the first place.

Help & Support

Getting in touch with an IOU Financial rep is easy. There is a blue envelope icon on the bottom right corner of each page allowing you to quickly send a message. Alternatively, you can call the company’s support team directly, which will get you a faster response. However, whereas many clients praise the professionalism and competence of IOU Financial’s support staff, others say the exact opposite, which suggests a certain inconsistency in the quality of their customer support.

The website is easy to navigate, with a clear structure and an appealing look. You will find a range of interesting material on small businesses, including a blog and informative videos.

User Reviews

Positive customer reviews often mention the helpful customer support IOU Financial provides. The company’s representatives are said to be competent, friendly, and easily reached. Many reviewers also point out the seamless application process which, many borrowers say is more transparent than with other comparable small business loan providers.

Comments bearing criticism suddenly experiences irregular cash flow.

We also looked at the National Funding reviews that were posted at BBB (with total of 28 reviews at the time of this National Funding review). The BBB gives National Funding an A+ ranking, but the average ranking is 3 stars and there are 46 customers complaints (in addition to the 28 reviews). Most of the complaints against National Funding referenced the company’s overly aggressive marketing teams, which can certainly be frustrating for applicants. However, complaints against the company that aren’t relevant to the actual funding and transfer of the loan are, in our opinion, a bit more comforting than those against companies whose borrowers had actual problems with their loan procurement or terms.

The majority of user reviews that address customer service are positive and this might be the reason why National Funding received recognition in 2013, 2014, 2015, 2016, and 2017 by Inc. Magazine and the San Diego Business Journal as one of the fastest growing companies both locally and nationwide.

Final Thoughts

A small business loan with a short-term loan provider like IOU Financial will obviously never be as affordable as a long-term loan with more traditional lenders, but as far as short-term lenders go, IOU Financial is a solid company with transparent terms and fees that provides competitive rates compared to many other lenders in this field. When doing research for this IOU Financial review we were happy to see the emphasis the company puts on their prepayment incentives: whereas many other short-term loan providers put a penalty on prepayments, IOU Financial encourages its clients to pay back their loans early, even providing a calculator that shows how much one can save by doing so.

While the application process is pretty fast and straightforward, we need to mention that there are other short-term lenders out there who require even less time and effort to apply. Whereas with many of IOU Financial’s direct competitors funding can be granted within 24 hours, this company usually takes at least 48 before funding is secured. While this is still pretty quick, it may be a consideration for some small business owners looking for extremely fast cash.